Second Quarter 2024 Review

Money Personalities

Francesca Federico Named One Of AdvisorHub’s 2024 Top RIAs To Watch

Tips to Build, Grow and Protect Your Wealth

Twelve Points Named to Inc.’s Annual List of Best Workplaces for 2024

What to do with Excess 529 Savings?

Appointed as Personal Representative in a Will? What to Know Before You Accept

First Quarter 2024 Review

Redefining the Role of Money for College Athletes: A Journey of Values and Empowerment

Transforming Perspectives: Why Young Adults Should Consider the Financial Services Industry

The Imperative of Building Businesses with Enduring Value and Freedom

Redefining Trust in the Financial Services Industry: A Journey of Empowerment and Liberation

Twelve Points Named #198 on the 2024 Inc. Regionals: Northeast list

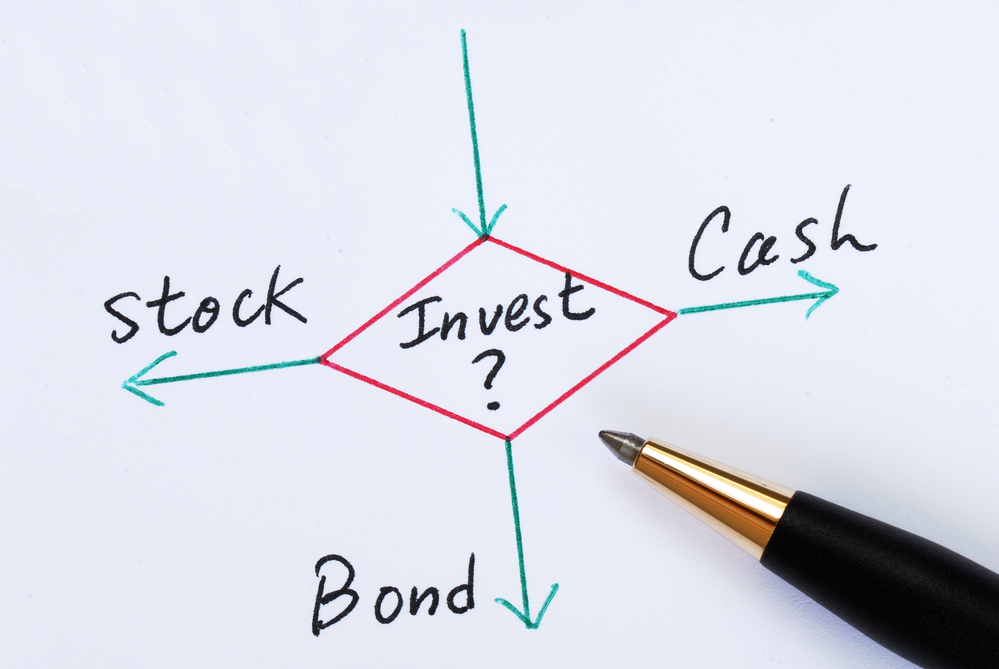

When You Can Afford to Save More, Where Should You Put It?

Fourth Quarter 2023 Review

Financial New Year’s Resolutions

Tame the Holiday Chaos and Avoid Overspending

Massachusetts Tax Relief Act – What’s In It For You?

Aging Parents’ Finances – When and How to Get Involved

Mass Lawyers Weekly Readers Vote Twelve Points A Top Firm In The 2023 Reader Rankings

Twelve Points is proud to be named #1 in Wealth Management in the Massachusetts Lawyers Weekly’s 2023 Reader Rankings. This is the fifth consecutive year that Twelve Points has been recognized by this publication. Each year, Massachusetts Lawyers Weekly Readers vote on which businesses they like most in Massachusetts based on their own experiences. We […]

Massachusetts Millionaire’s Tax: What You Don’t Know Can Hurt You!

The College Conversation

Second Quarter 2023 Review

How to Protect Yourself from Cyber Attacks

Do You Need to Hire a Professional Trustee?

Safeguarding Your Finances As You Age

Fourth Quarter 2022 Review

<a>Welcome Our Newest Team Member: Tracey Hartford</a>

December 2022 Market Outlook

November 2022 Market Outlook

First Steps For The Financially Reluctant Widow

October 2022 Market Outlook

Third Quarter 2022 Review

Dare to Dream, Again

September 2022 Market Outlook

Running with the Mustangs

Beyond Estate Planning: An Annual Financial Checklist

July 2022 Market Outlook

Second Quarter 2022 Review

June 2022 Market Outlook

May 2022 Market Outlook

2021 Napa Top Advisor Firm Recipient

April 2022 Market Outlook

2022 Five Star Wealth Manager Award Recipients

First Quarter 2022 Review

March 2022 Market Outlook

January 2022 Market Outlook

Fourth Quarter 2021 Review

December 2021 Market Outlook

November 2021 Market Outlook

October 2021 Market Outlook

Third Quarter 2021 Review

September 2021 Market Outlook

Twelve Points Named #4,480

Mass Lawyers Weekly Readers Vote Twelve Points a Top Firm in the 2021 Reader Rankings

August 2021 Market Outlook

July 2021 Market Outlook

June 2021 Market Outlook

May 2021 Market Outlook

Podcast: How Deb Cartisser Empowers Women

The Boston Podcast Network recently welcomed our COO Deb Cartisser for an episode called “She’s So Money: How Deb Cartisser Empower Women.”

Twelve Points Receives 2021 Award from The Startup Weekly

Twelve Points was recently recognized by The Startup Weekly as one of the 2021 Financial Services & Insurance Companies to Watch.

Twelve Points Named to List of 2020 NAPA Top DC Advisor Teams

NAPA recently unveiled its list of 2020 NAPA Top DC Advisor Teams, and Twelve Points is honored to be included on this distinguished industry list.

April 2021 Market Outlook

Podcast: The Story Behind Her Success featuring Francesca Federico

Francesca offers her thoughts and advice about how to empower yourself by protecting your financial future.

March 2021 Market Outlook

February 2021 Market Outlook

David Clayman and Francesca Federico Receive 2021 Five Star Award

We are proud to announce that our very own Francesca Federico has been recognized by the National Association of Plan Advisors as one of the Top Women Advisors for 2020. Her talent and efforts earned her the level of “Captain”, one of only 50 to be recognized at this highest designation.

January 2021 Market Outlook

December 2020 Market Outlook

Hello friends, welcome to the December 2020 market outlook. We hope this letter finds you well and your families enjoyed a wonderful Thanksgiving. Obviously, this year was different from a variety of ways. But with the holiday season upon us, we’re approaching the end of a dreadful year. Here’s to 2021 being a major improvement. Let’s dive in.

Francesca Federico named one of NAPA’s Top Women Advisors

We are proud to announce that our very own Francesca Federico has been recognized by the National Association of Plan Advisors as one of the Top Women Advisors for 2020. Her talent and efforts earned her the level of “Captain”, one of only 50 to be recognized at this highest designation.

Twelve Points Named #860 on Inc. 5000

When Inc. Magazine released this year’s Inc. 5000 list, our team was thrilled to see that we not only were on the list for the second year in a row, but we had risen by over 3,000 places!

CARES Act For Businesses, Sole Proprietors and Independent Contractors

Employers are able to postpone the amount of payroll tax they pay on employees’ salaries attributable for 2020. If elected, half of these taxes will be due 12/31/2021 and the remaining half by 12/31/2022.

Coronavirus Aid, Relief and Economic Security (CARES) Act Provisions

Financial support for individuals is available in a one-time check or direct deposit, which will be sent from the US Treasury. The full credit amount is $1,200 for individuals, $2,400 for couples and $500 for children under age 17.

Families First Coronavirus Response Act: Employee Paid Leave Rights

Paid sick leave and family leave is available to employees of small and mid-sized companies under 500 employees from 4/2/2020 to 12/31/2020. Under this plan, the company pays its employees and is reimbursed by the government in the form of a payroll tax credit.

Loans Permitted From Some Retirement Accounts

Early withdrawals, prior to age 59 ½, are permitted this year without the customary 10% penalty. Loans from certain retirement accounts are available for up to $100,000 or 100% of the vested interest in an account.

Market Outlook

First and foremost, I hope this note finds you, your families and loved ones healthy and well. These are trying times but we will get through this together. Social distancing is imperative right now, especially since it seems to be working.

Is This a Good Time For a Roth IRA Conversion?

Whether you are in the early stages of building your retirement nest egg or you are lucky enough to have already accumulated a significant amount of assets in tax-preferential accounts, this could be a good time to consider having some of the funds located in after-tax or “Roth” accounts.

Required Minimum Distributions Suspended for 2020

he Coronavirus Pandemic has impacted so many areas of our lives, but there is one bright spot. The Required Minimum Distribution (RMD) Rules for IRAs and other Qualified Plans have been modified for 2020.

Tips for Strategic Giving

The end of the year is a great time to ensure that you are using the right tools and techniques to maximizing your annual gifting program to family and philanthropy. This month, we discuss the spectrum of gifting strategies, such as traditional or outright cash gifts, dealing with more complex assets, and gifting for families with young children. We also review the impact of charitable gifting on income taxes.

Student Loan Debt Affects Relationships. Financial Planning Can Help.

A recent CNBC article reveals just how concerned couples are about their student loan debt. The article 1 in 8 Divorces Is Caused by Student Loans is stunning and points out how these debts need to be talked about more seriously and more often.

Keep Your Family Safe with These Essential Legal Documents

This month, we look at the legal documents to keep you and your family safe and sound. We’ll dive into estate planning topics such as living trusts, wills, the variations on power of attorney (durable, nondurable, special, limited, springing, and medical), advanced medical directives, and protection plans for children.

Why the Stock Market Is Not the Economy

When the economy is roaring, we take it as a given that the stock market must be rallying too. Low unemployment, high GDP numbers, and robust wage growth all bode well for a soaring stock market.

Planning for College: Savings and Financial Aid Tips

We pull back the veil of higher education savings to help you prepare for your child’s education path. We discuss higher education plans like 529 plans and Coverdell ESA, as well as financial aid programs such as FAFSA, MEFA, and federal/private loans.

Dangerous Curve Ahead: What the Yield Curve Foretells

If you’ve ever flipped on the TV and landed on Bloomberg television or CNBC you might hear them reference the yield curve when talking about the future prospects of the economy.

Why Does The “Strong Dollar” Matter?

From commodities like gold and oil, to emerging market debt and equities, you will hear the price movement of almost everything tied to the price of the U.S. dollar.

Use This Template to Easily Budget Your Life

Budgeting helps to paint the big picture view of what your financial future will look like and how you can live within your means. By accounting for how much money you make and keeping track of how much you spend, you can have the peace of mind knowing that you won’t run into trouble

Organize Your Financial Life This Summer

This month we look into how to organize your finance records and cash flows, as well recovering important documents and unclaimed accounts. We dive into essential records: What are they, how long should they be kept, and where?

Your New Summer Project: Organizing Your Finances

Have you ever received a financial document that you just didn’t know what to do with? You can’t throw it away because, who knows, you could need it down the line at some point.

The Twelve Points Team Reflects on Four Years of Business

This June marked the fourth anniversary of Twelve Points’ founding. Over the years, we’ve helped countless families and individuals better understand and plan towards their financial goals, whether they be paying for college, buying a second home, or retiring early. Along the way,

Tariffs Are One Thing, Investment Is Another

The market has been shrugging off the escalation of the trade war until June 25, 2018, when the S&P 500 ended the day down 1.37% and the Nasdaq ended down 2.09%. Over the past several months,

Gauging the Economic Impact of Elections in Italy and Spain

Equity and debt markets had a wild swing after the election of new government leaders in Italy, while there was little to no reaction over Spain’s similar vote. The reason for this discrepancy is that across most of Spain’s popular parties, there has been no sentiment to abandon the Euro

Managing Your Finances as a Young Professional

Throughout college, every student has a different level of financial independence. Whether you are supported by family, a part-time job, student loans, or any combination of the three, after graduation and becoming a young professional, the safety net tends to disappear.

Earnings Begin to Show the Cracks in U.S. Equities

Intuitively, when a company beats earnings expectations, the share price should go up. Under performing expectations should see prices go down. And meeting expectations should keep prices relatively unchanged.

Finance Tips for Young Professionals

In this webinar we tackle the finance topics posing road blocks specifically to young professionals including debt, saving and house buying. We’ll look at debt from student loans, auto loans, and mortgages; savings plans with 401(k), Roth/traditional IRA, compound interest, and budgeting; and renting vs. purchasing property.

A Step by Step Guide to Building Your Budget

Technology has allowed individuals to easily keep track of their finances down to the last penny, but you don’t have to track down every dollar to make a simple and helpful budget. Whether it is in a notebook, a spreadsheet or using an app

Why Non-U.S. Equities Should Be a Core Part of Your Portfolio

The wealth management industry has become plagued by cookie cutter portfolios with a standard mix of 60% stocks and 40% bonds; the goal being to perform no better or worse than the guy next to you.

Make the Most of Your Investment Opportunities

Technology has enabled the retail investor to have access to dozens of different asset classes and financial products previously only available to investment professionals. The democratization of the financial markets through easy accessibility

Twelve Points & Community Servings Feed Those in Need

One of our core values at Twelve Points is to be helpful. We as a firm believe in giving back to our communities in numerous ways. Our colleagues Manny and Francesca work closely with Community Servings and brought the organization’s mission to our attention.

Things to Know When Buying or Selling a Home

Buying and selling real estate is one of the most confusing and multi-pronged undertakings you’ll ever be involved with. Twelve Points breaks down the process for you with easy-to-understand discussions, including topics of credit scores, affordability,

Tips for Millennials: Balancing Debt & Savings

As millennials, we have two tips we’d like to share with you regarding debt and savings. Let’s start with a tip on savings. If you have a 401(k) plan offered to you at work, absolutely start contributing to that immediately.