Hello friends, welcome to the May market outlook. It’s our hope this note finds you and your loved ones well, and Spring has added a pep to your step. The warmer weather is certainly welcome here in New England. Just like we snapped into spring, it seems we’re on the brink of partially snapping out of the pandemic, at least here in the United States. Elsewhere, Covid continues to be a dire problem. Presently, India, Brazil and parts of Europe are facing terrible outcomes. Globally, we have surpassed 3 million deaths, with many more expected through the remainder of the year. We continue to have problems with variant strains, but the vaccines that have been rolled out so far have been effective. Here in the U.S., anyone over the age of 16 is now eligible for the vaccine, and 90% of the population lives within 5 miles of a vaccine site, certainly a positive outcome for the last year, and why the U.S. is arguably in the best position for recovery next to China and parts of Asia, who have more experience dealing with corona viruses. Most of China at this point has re-opened, but for the global economy to truly revert back to 2019 levels, we very much need the rest of the world to catch up. So where do we go from here? That’s the trillion dollar question, so let’s jump right in.

We just received Q1 GDP numbers, and the U.S. grew by 6.4%, which was just below the 6.7% estimate. We expect Q2 GDP numbers to be even higher as the re-opening picks up steam and those looking for a job are able to get back to work. On the other hand, we still have a very high unemployment rate. Our largest challenge to face may be inflationary pressures due to supply constraints which are expected to last through the remainder of the year at a minimum. Getting back to work will be key to lessen the supply pressures. For some companies, like Alphabet, the ability to work from home has been a bonus. Google said they’re saving close to a billion dollars a year by having their employees work from home. For others, like your mom-and-pop restaurant, local distributor, local manufacturer, construction and heavy equipment, trucking etc., they’re finding it nearly impossible to find help, which is slowing the recovery. It’s our hope that government benefits, as much as they’re currently needed, have a short lifespan. The key to our economy is getting everyone back to work, increasing wages and hopefully, increasing consumption. After all, we’re the number one service economy on the planet.

The April Federal Open Market Committee (FOMC) meeting just ended, and as expected didn’t produce any policy surprises, or even an update for that matter. What we know to be true: The Fed will remain ultra-accommodative, rates will stay at zero, and asset purchases of $120 billion per month will continue. The Fed is adamant about getting back to maximum employment. Inflation will be viewed as “transitory” until deemed otherwise. What could change that? Inflation persisting well into 2022-2023, or rising far above 2% (on the order of 4% readings m/m for 3-4 months). We’re not quite convinced that inflation is as transitory as the Fed proclaims. Only supply lines fully reverting to normal around the world and getting people back to work would allow this to happen. But, after 30 years of a deflationary environment and lackluster growth, we should be patient before looking to raise rates, especially after considering the amount of debt we’ve added over the last year.

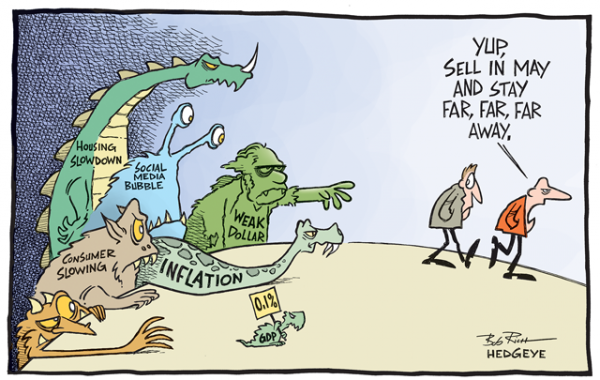

We’re currently in the middle of earnings season. The results have been good but not stellar, which is why the market has been trading sideways for the last three weeks. The good earnings have been priced in, arguably since the recovery heated up in the late summer/early fall of 2020. The real question is where do we go from here? Are companies in a strong position to grow? Or is the expectation that earnings decline as we muddle through the ashes of covid-19? One place to look, where are the rise in costs going? Procter and Gamble said this on last week’s conference call regarding their cost of inflation: “Commodities are now forecast to be a headwind of approximately $125 million after tax. This is a $400 million swing to the negative since our initial guidance for the year with much of this impact affecting our fiscal fourth quarter. The commodity cost challenges we face this year will, obviously, be larger next fiscal year. We will offset a portion of this impact with price increases. The exact timing and amount of increases vary by brand and sub-brand in the range of mid to high single digits. We are analyzing raw material and Foreign Exchange impacts on other categories and markets, and we are assessing the need for additional pricing moves.” United Microelectronics last week said they are raising semiconductor prices by 40% in 2022. And over just 24 hours we saw fresh production warnings from Honda, BMW, and Ford over their inability to acquire semiconductors and maintain production. This tells us that either valuations need to come down to meet earnings, or, earnings need to pick up pace to match valuations. Our bet is on the former, but given the amount of liquidity and speculation in the market, indices and stock prices could continue to run away. To add to the inflationary theme, it does appear that the bond market is siding with Chairman Powell, as real rates have slowed down their acceleration. This has benefited the stock market and will continue to if the 10-year yield can trace lower. But we expect the 10-year yield to do the opposite over the intermediate, and rise to 1.75% again, which may be an opportunity to reallocate some assets to bonds.

Last but not least, we heard from President Biden after his first 100 days in office and he provided a road map of where we’re headed. Taxes are going up. Unfortunately, some of the recovery will depend on what degree tax increases we’ll see, when they will happen and what behavior that alters. The administration is also proposing a $2 trillion dollar infrastructure bill and a $1.8 trillion dollar bill for families and children. These are 10 year packages and it’s quite uncertain how they will play out. Our best guess, these will be bargaining chips as we move towards the mid-term elections.

As we look ahead, we believe the market could be facing some short term headwinds, but we don’t expect any troubling waters over the near term. It’s our expectation that we will face a muted summer, with markets primarily trading sideways, with an expectation that volatility picks up this fall. Please stay safe, diligent and reach out with any questions.