Written by: Joey Waterman

Think of tariffs as an admission fee your government puts on imported goods. A tariff is a tax placed on products coming into the country, often with the goals of protecting domestic industries, raising government revenue, or gaining leverage in trade negotiations (sometimes all three).

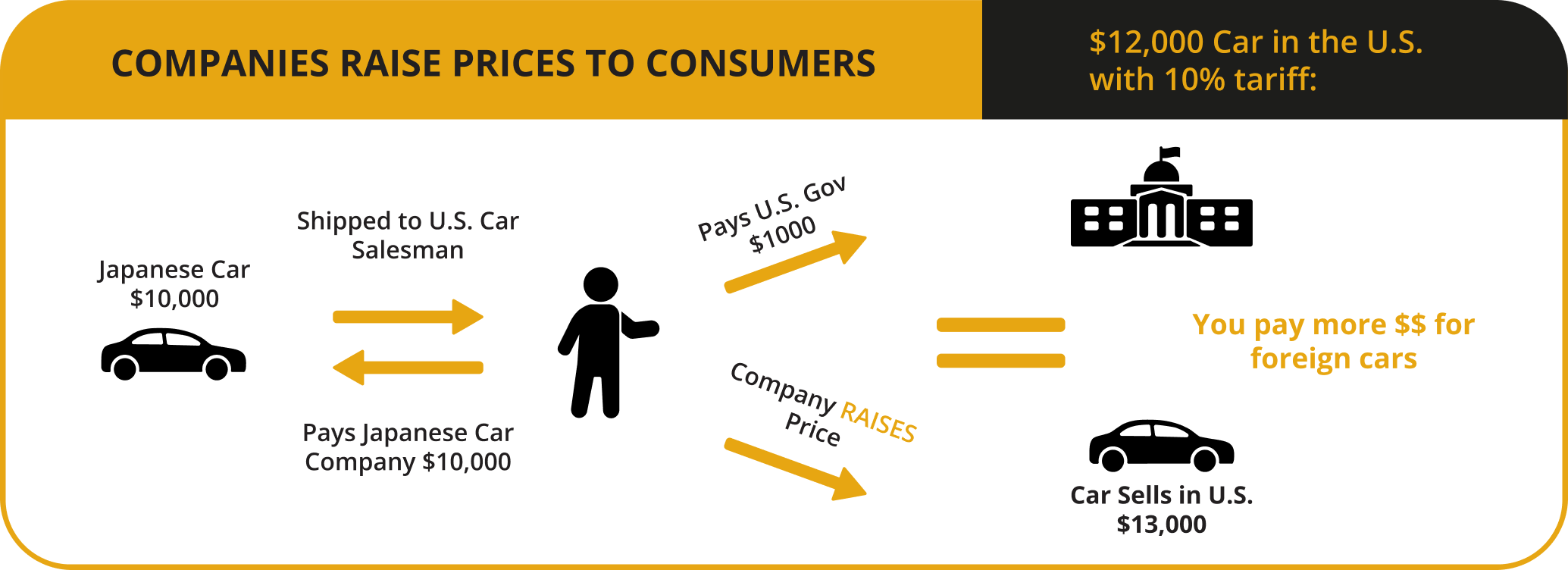

Most tariffs are calculated as a percentage of the item’s value, the price the U.S. company pays for the item. For example, if a U.S. company imports $1,000 worth of goods and the tariff is 10%, they’ll pay an additional $100 in tax for the tariff. Now that same item costs the U.S. company $1,100.

How Tariffs Impact Consumers

Here’s the kicker: although companies pay the tariffs up front, many of those costs trickle down to you, the consumer. Businesses are usually not keen on shrinking profit margins, so price hikes are often inevitable.

According to a 2025 survey by Gartner Group (a global research and advisory firm), 73% of tariff-related cost increases are passed on to consumers. Even more telling, nearly 60% of business leaders surveyed said they would absorb less than 10% of those increased costs themselves. Translation? You may feel the pinch when shopping for everyday goods.

What This Means for Your 401(k)

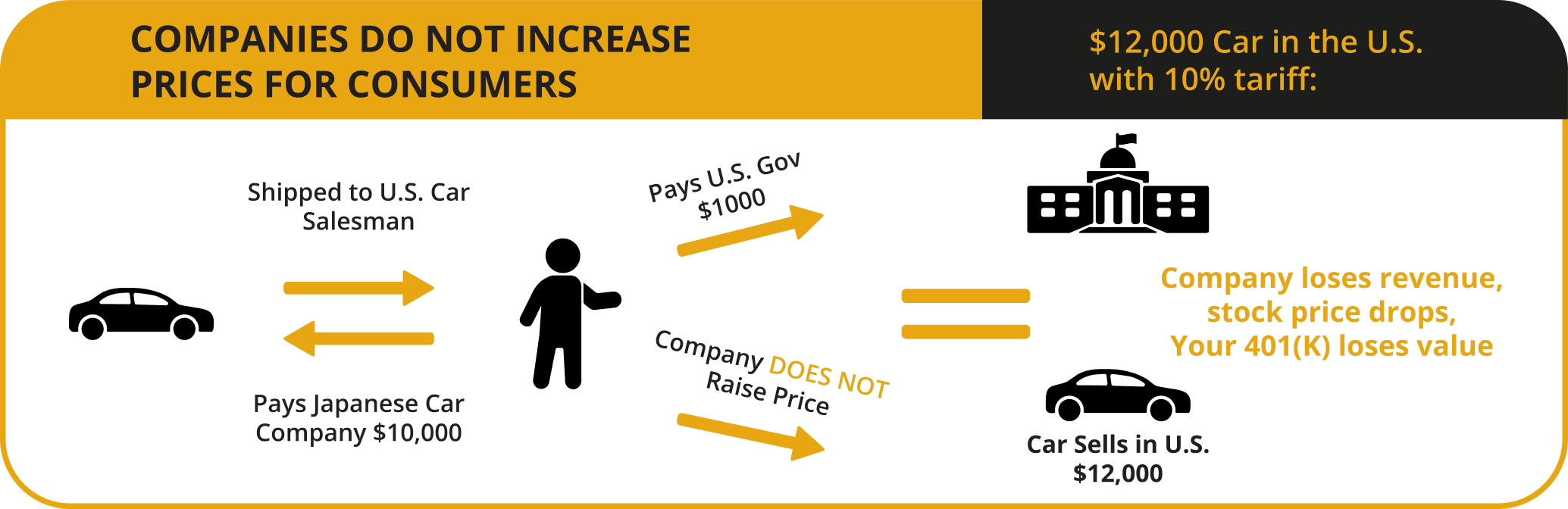

Even if price tags don’t change, tariffs and the trade tensions that often come with them can cause stock markets to zigzag. Higher costs can lead to lower profits for companies, and lower profits can mean falling stock prices.

Before you panic and hit the “sell everything!” button, take a deep breath. The market moves in cycles, and knee-jerk reactions can do more harm than good. Instead, review your portfolio to see how exposed you are to industries or countries affected by tariffs. Then focus on long-term strategies designed to weather short-term market turbulence.

How Tariffs Can Benefit America

Tariffs tend to get a bad rap, but they’re not all doom and gloom. In fact, they’ve played a major role in U.S. economic history. In addition to increasing revenue to the U.S. government, here are some quick examples of how they have helped U.S. industries:

- Tariffs protected American textile makers in the 1800s.

- Why: The U.S. textile industry was still developing textile technology and couldn’t compete with Britain’s more advanced and efficient factories.

- They shielded the steel industry in the 1900s.

- Why: To protect domestic industry from cheaper foreign goods produced with lower labor costs, weaker regulations, and sometimes government subsidies.

- They helped U.S. automakers stay competitive in the 1980s.

- Why: Japanese carmakers were producing cheaper, more fuel-efficient cars that were gaining U.S. market share, threatening domestic auto jobs. This protected U.S. automakers until they could design their own smaller cars.

Here’s a simplified example: If China can sell steel for $10 per pound and the U.S. can only make it for $11, consumers would naturally choose the less expensive Chinese steel. But if the U.S. imposes a 25% tariff, Chinese steel now costs $12.50, making American steel at $11 the better deal.

This “breathing room” allows U.S. companies time to develop better technology, reduce costs, and eventually compete without needing protective tariffs.

So, Are Tariffs “Good” or “Bad”?

It’s tempting to pick a side, but tariffs can be either good or bad depending upon your point of view. They can protect jobs and industries in the short term, but they can also raise costs for consumers and investors and increase revenue to the U.S. government.

The key takeaway? Stay informed, diversify where you shop and invest, and plan with the bigger picture in mind. Markets and trade policies will always shift, but a long-term strategy (and a good financial advisor) can help you turn potential challenges into opportunities.

Connect with the Twelve Points team today to learn more about how tariffs impact your 401(k), and your wallet.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION AT www.twelvepointswealth.com/disclosure