The S & P 500® was up 2.5% during the quarter, the MSCI All-Country World Index® declined by -0.8% and the Bloomberg Global Aggregate Bond Index declined by -5.1% as economic strength and sticky inflation in the US put upward pressure on US interest rates which reverberated across equity and bond markets around the World. US Mega Cap Growth stocks rose by 6.8% while the equally weighted S & P 500 index fell by -1.8% and the S & P 600 Small Cap Index fell by -0.7%, as investors sought refuge from the global market volatility by buying the “Magnificent Seven.” Returns among other asset classes beyond equities were mostly negative as well. Short-term Bonds (-2.3%) and Long-term Bonds (-16.1%) also showed significant divergence as longer maturity bonds, being more sensitive to changes in interest rates, had a greater reaction to the rise in US rates, with Global Bonds(ex-US) down -6.4% as well. Material stocks (-12.2%) were the worst performing sector this quarter as investors expressed concerns over a global growth slowdown. Most sectors were down this quarter: Industrial Stocks (-2.2%); Consumer Staples (- 4.6%); Healthcare (-10.3%); REITs (-8.0%) and Utilities which were down (-5.5%). In the positive column, Consumer Discretionary Stocks (+12.2%); Financials (+7.1%); and Technology (+3.2%) all gained. Precious metals were down slightly (Gold -0.4%) while the broad Commodities indices were up about 1%. The Global 60/40 portfolio returned -2.5% for the quarter reflecting the aforementioned weakness in both stocks and bonds. Most of our risk model portfolios performed ahead of their weighted benchmarks for the quarter with the remainder in-line.

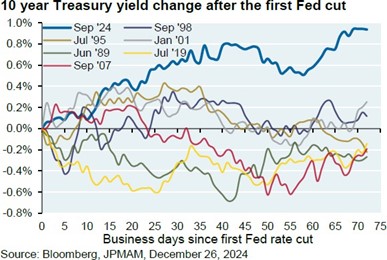

With the US election settled more decisively than expected, the equity market rallied strongly in November but then ran into a wall in December as the Federal Reserve cut the Federal Funds rate despite further evidence of sticky inflation and a stronger than expected US economy (which puts upward pressure on the required real interest rate). Unlike prior cutting cycles, the Fed has been cutting short term rates into economic strength rather than weakness. The chart to the right from JP Morgan shows how the bond market’s reaction to this cutting cycle has been very different to the prior six cycles. Furthermore, the Fed acknowledged both the strength of the economy and the lack of further progress in reducing inflation by reintroducing the concept of two- sided risk to their management of the Federal Funds rate. That is, they explicitly stated that they would be willing to raise interest rates again if inflation expectations began rising on a persistent basis. Investors responding to this by reducing their expectations for Fed Funds rate cuts this year from four to one, which added to the downside volatility in December.

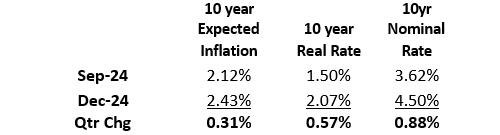

Those concerns are best illustrated by looking at the changes during the fourth quarter in the 10- year US Treasury yield:

Source: Federal Reserve Bank of Cleveland, Factset

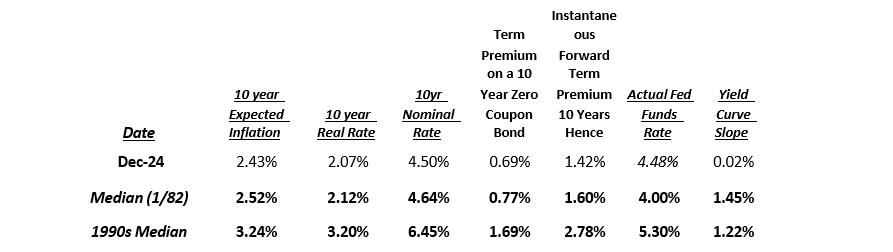

Despite the volatility caused by the back up in interest rates, the benchmark 10-year Treasury Bond is as close to “normal”, when looking at the median statistics over the last 42 years, as it has been in since the Great Financial Crisis (“GFC”) in 2007-2008:

Source: Federal Reserve Bank of Cleveland, Factset

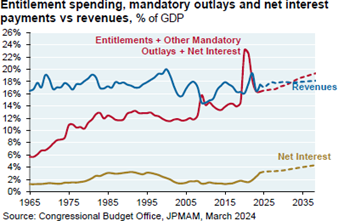

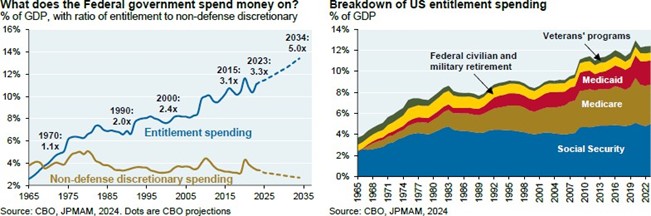

In fact, we would argue that much of the recent bond market volatility stems from investors thinking that the 15 years post the GFC were normal (or the new normal), yet zooming out and looking at the longer-term financial history of the US would show that those years were an anomaly. As an aside, we believe that the US Government’s decision to finance government operations using short-term instruments such as three- and six-month T-Bills post-Covid and a general unwillingness to extend the maturity of our debt during that time, will be viewed through the lens of history as a once in a generation opportunity to improve the fiscal budget deficit that was squandered. In the chart above/right from JP Morgan, you can see we are about 10 years away from the cross-over point where mandatory expenditures (e.g. Medicare/Social Security) and net interest costs exceeds US Government revenues (Taxes, etc.).

In fact, one could argue that with such a flat yield curve (2 bps) between the Federal Funds rate and the 10- year Treasury bond, the Treasury should still take advantage of the current conditions and increase the mix toward longer dated maturities.

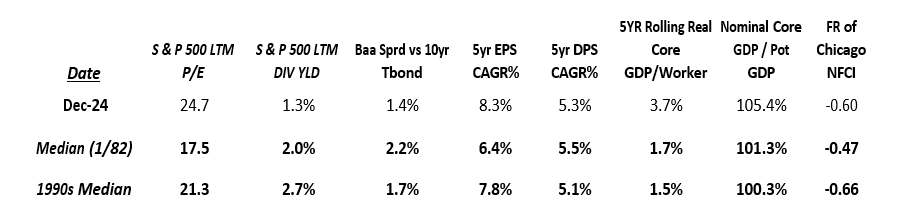

In the table above, we’ve also included the same statistics for the decade of the 1990s. We’ve taken the position for a while that current economic and financial conditions remind us (fondly) of the 1990s.

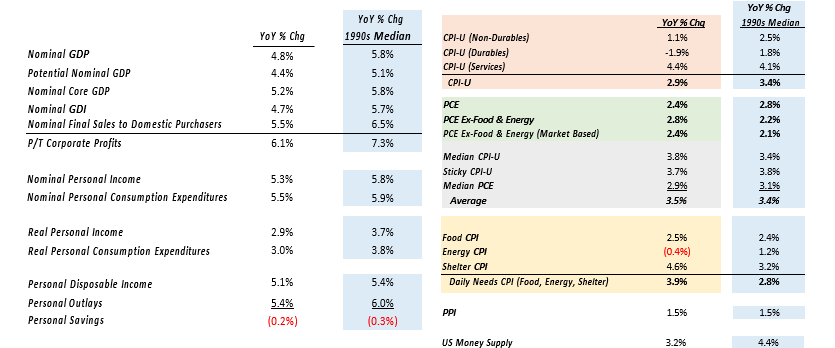

The table below looks at a comparison that includes statistics for the S & P 500 in addition to statistics for economic and financial conditions:

Source: Federal Reserve Bank of Cleveland, Factset

What we see in the table above is that financial conditions are loose as measured by the Federal Reserve (FR) of Chicago’s National Financial Conditions Index (NFCI); productivity is currently running ahead of its long-term median; together allowing the economy to run at about 105% of its potential. US corporate growth (earnings and dividends) rates are in-line to slightly ahead of their long-term medians. Lest you think we are cherry picking the statistics, please review the following broader list which is a sub-set of the statistics we track:

Source: St. Louis Federal Reserve

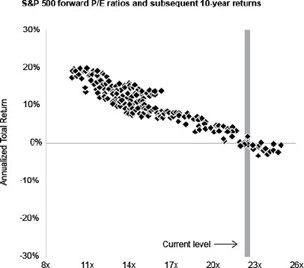

During the decade of the 1990s, stocks as measured by the S & P 500 compounded at 18.2% and bonds as measured by the Bloomberg US Aggregate returned 7.7% (similar to its starting yield of approximately 7.9%). In contrast, during the first five years of this decade, stocks have returned 14.4% and the Bloomberg US Aggregate returned -0.3% (with a starting yield of only 2.0%). What stands out the most in the S & P 500 valuation data on the table above is where we are today. We’ve discussed how the current valuation of the size-weighted S & P 500 is historically high at nearly 25X last twelve months earnings. By way of contrast, the S & P traded at 15.2X earnings in December of 1989 and 20.2X earnings in December of 2019. We have never believed valuation to be a useful timing tool — one can grow old (and insolvent) waiting for investors to care about valuation – until they do. We prefer to look at valuation more as a risk management tool as history has shown that starting valuation has a high correlation to long-term returns. That is, low starting valuations result in high compounded returns 10 years later and vice-versa. One of the best representations of this relationship we have seen comes from JP Morgan via Howard Marks/Oaktree Capital Management’s year end letter to clients and while this chart uses forward earnings vs. trailing earnings – the negative relationship between valuation and long-term returns is clear (measurement period is 1988 to 2014). Source: JP Morgan and Oaktree Capital Management

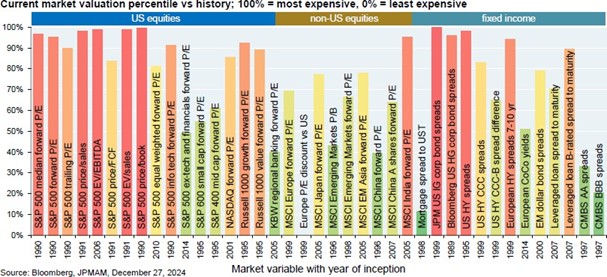

If the size-weighted S & P 500 is facing a head-wind in terms of its valuation – then what isn’t? Fortunately for us, just about everything else. The chart below is from JP Morgan and shows most other global markets are historically attractive vs the S & P 500. For us, this is a great time to be diversified both globally and across asset classes.

We at Twelve Points Wealth hope you and your families are well. Please call or email if you have any questions.

Important Disclosure Information

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Twelve Points Wealth Management (“Twelve Points Wealth”), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Twelve Points Wealth. No amount of prior experience or success should not be construed that a certain level of results or satisfaction if Twelve Points Wealth is engaged, or continues to be engaged, to provide investment advisory services. Twelve Points Wealth is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Twelve Points Wealth’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.twelvepointswealth.com. Please Remember: If you are a Twelve Points Wealth client, please contact Twelve Points Wealth, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Twelve Points Wealth account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Twelve Points Wealth accounts; and, (3) a description of each comparative benchmark/index is available upon request.

*Please Note: Ranking Limitations. Neither rankings nor recognitions by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any professional designation, certification, degree, or license, membership in any professional organization, or any amount of prior experience or success, should be construed by a client or prospective client as a guarantee that the client will experience a certain level of results if the investment professional or the investment professional’s firm is engaged, or continues to be engaged, to provide investment advisory services. A fee was not paid by either the investment professional or the investment professional’s firm to receive the ranking. The ranking is based upon specific criteria and methodology (see ranking criteria/methodology). No ranking or recognition should be construed as an endorsement by any past or current client of the investment professional or the investment professional’s firm. ANY QUESTIONS: Twelve Points Wealth’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.

Disclaimer: Historical data is not a guarantee that any of the events described will occur or that any strategy will be successful. Past performance is not indicative of future results. Returns and data cited above are from various sources including FactSet, Bloomberg, Russell Associates, S&P Dow Jones, MSCI Inc., The St. Louis Federal Reserve, and FactSet, Inc. The content is developed from sources believed to be providing accurate information.

The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security. Investing involves risks, including possible loss of principal. Please consider the investment objectives, risks, charges, and expenses of any security carefully before investing.

Twelve Points Wealth Management, LLC is an investment adviser located in Concord, Massachusetts. Twelve Points Wealth Management, LLC is registered with the Securities and Exchange Commission (SEC). Registration of an investment adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the Commission. Twelve Points Wealth Management, LLC only transacts business in states in which it is properly registered or is excluded or exempted from registration.